Africa Climate Summit - What You Need to Know

Africa Climate Summit - What You Need to Know

Africa Climate Summit - What You Need to Know

MARKET UPDATES

September 18, 2023

Grace Lam

·

Co-founder

Mar Velasco

·

Co-founder

Last week saw the inaugural Africa Climate Summit (ACS) held in Nairobi, hosted by Kenyan President William Ruto. Around 30,000 delegates from around the world attended, including US Climate Envoy John Kerry, Secretary-General of the UN António Guterres, and European Commission President Ursula Von Leyen. A precursor to COP28, the summit served as a platform to inform, frame, and influence commitments and pledges to reduce carbon emissions, with a focus on African markets.

The summit saw the signing of the Nairobi Declaration on September 6th. This calls for urgent action to address climate change, including:

The mobilization of $100bn in climate finance for Africa by 2025, supported by taxes on emissionsIncreasing Africa’s renewable energy capacity to at least 300GW by 2030

Reformation of the global financial system to be more responsive to Africa’s needs

Developing new opportunities to process raw materials within AfricaRecognizing Africa’s historical responsibility for climate change and its disproportionate vulnerability to its impacts

Having closely followed the conversations at ACS with our partners and friends, the team at Netacarbon wants to share with you the key highlights we are most excited about!

#1 | Global carbon tax proposal

One of the headline-grabbing moments at ACS was the proposal by African countries for a global carbon tax. This would enable major polluters to support poor nations in financing the rollout of green energy systems, addressing an urgent need for climate financing, and redressing inequities between those contributing to carbon emissions and those affected by them. The proposal includes a carbon tax on fossil fuel trade, maritime transport, and aviation, which could be augmented by a global financial transaction tax (FTT), and would provide ring-fenced “affordable finance for climate positive investments at scale”, independent of geopolitical and national interests. The tax could raise an estimated $100bn each year, providing another avenue to support local climate projects.

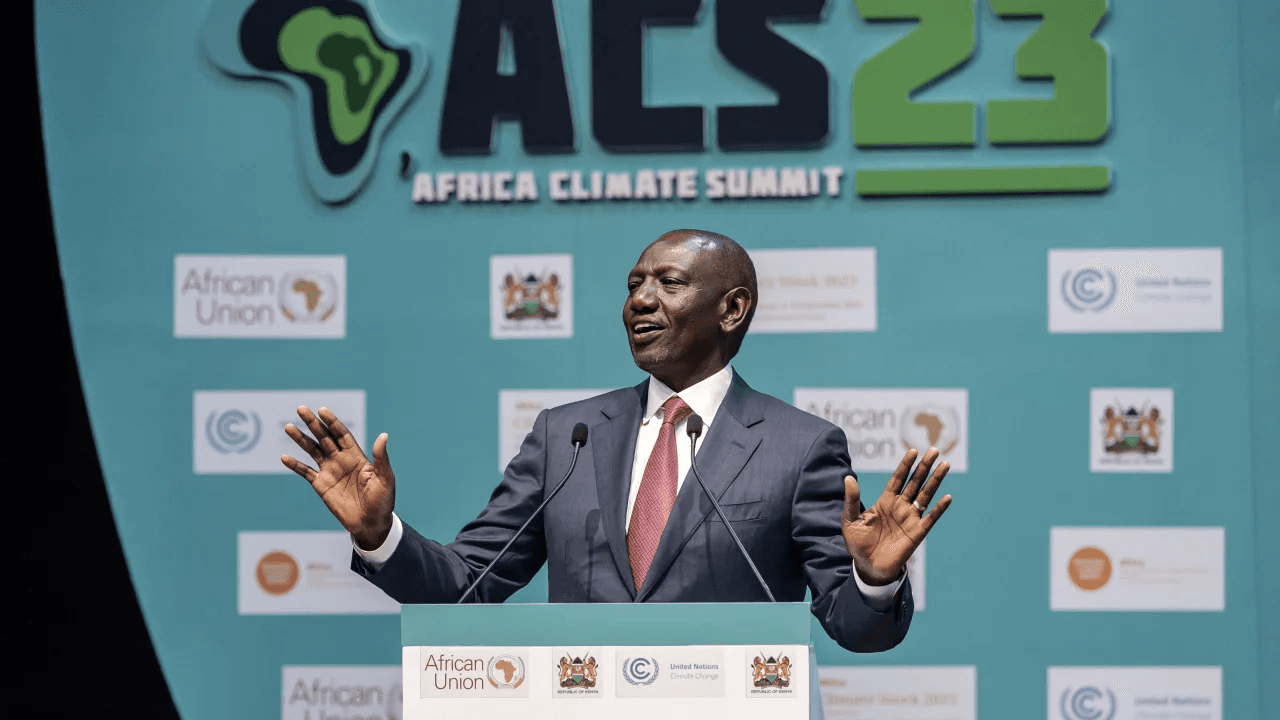

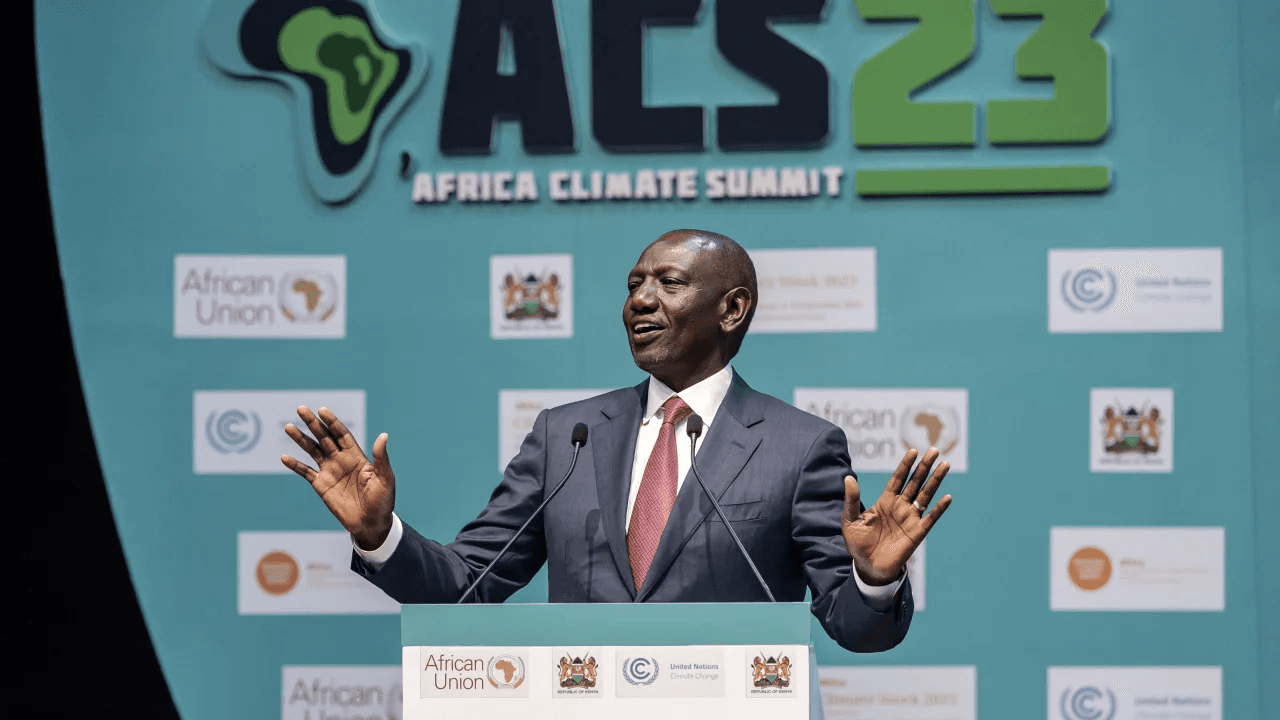

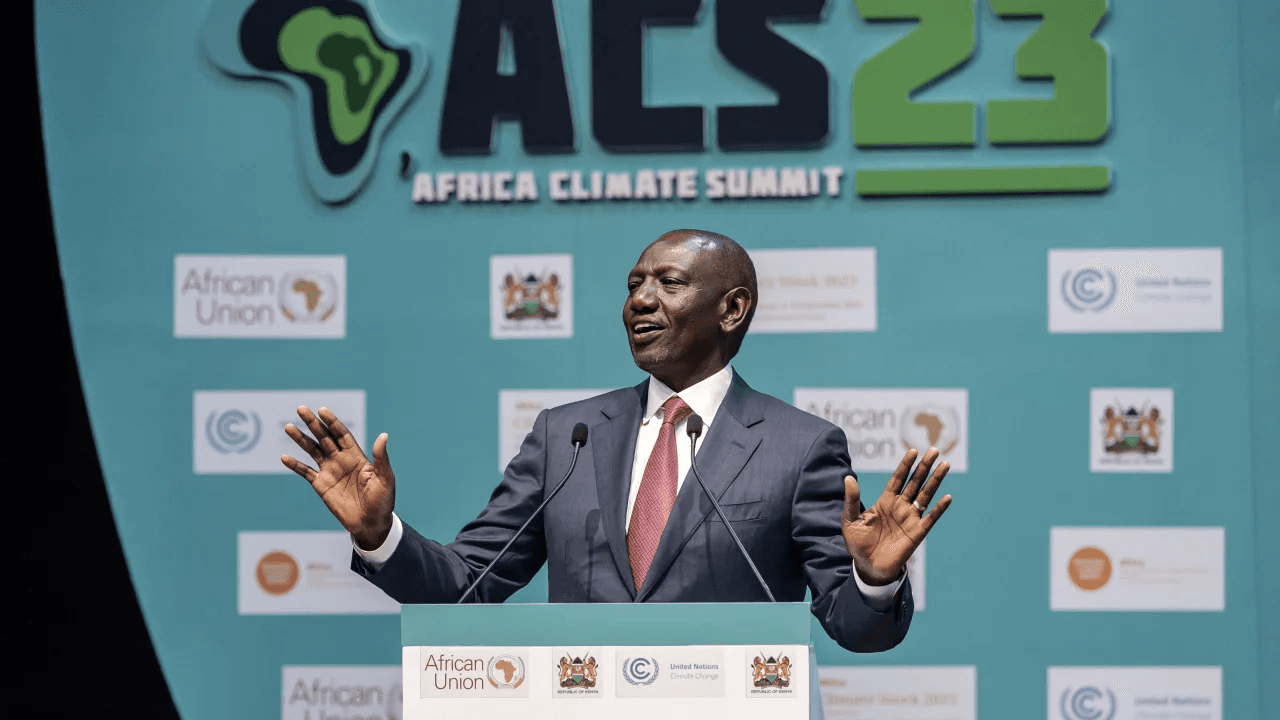

“What we are saying is that we want to pay. We do not want to say ‘let those guys pay because they are the polluters’, we are saying, ‘let’s all pay’, and then let’s have a mechanism where we invest these resources where we unlock the biggest value on decarbonisation.”

— William Ruto, Kenyan President and Host of the ACS

Luis Tato/AFP via Getty Images

#2 | Announcements of major investments in the carbon market

There were many exciting announcements of investment in climate initiatives at the summit:

Investors from the UAE committed to buying $450m of carbon credits from the Africa Carbon Markets Initiative (ACMI), launched at the COP27 summit hosted in Egypt last summer

The U.S. announced key investments during the summit totalling $280m across multiple agencies including USAID, the U.S. International Development Finance Corporation (DFC), and the President’s Emergency Plan for Adaptation and Resilience (PREPARE) in Africa. This includes investments to help derisk carbon finance, fund carbon projects, support the Kenyan government to develop its carbon market activiatoin plan.

Climate Asset Management, a joint venture between HSBC and Pollination, a specialist climate investment firm, also announced a $200m investment in projects producing ACMI credits

According to the non-profit Climate Policy Initiative, Africa has only received about 12% of the money it needs to cope with climate impacts. These investments signal an increased commitment to climate resilience, and could catalyze the development of many carbon projects, but must be a foundation for further sustained investment.

#3 | Progress on the Africa Carbon Markets Initiative (ACMI)

William Asiko from the Rockefeller Foundation, co-creator of the ACMI, used the summit as a platform to share progress made by the ACMI since COP27. This includes:

Engagement with more than 20 countries, six of whom, including Kenya, are on the brink of starting work to develop their carbon market structure with the help of ACMI

Advanced Market Commitments of $200m for carbon credits by major global companies including Standard Chartered, Vertree, ETG, and Nando’s

Upcoming auctions on African carbon credits held by three major international exchanges and auction housesUpcoming collaboration on financial mechanisms with major financiers, including Standard Chartered, the African Development Bank, and FSD, to increase capital flows into carbon credit reduction projects

Drafting of the inaugural Carbon Credit Showcase, which will represent 92 projects from 63 developers across 23 countries

Underlying this progress was the message that they were at the beginning of the journey to fulfill carbon credit potential in Africa, presenting a significant unclaimed market opportunity. We have highlighted this opportunity ourselves in previous blog posts, such as the market sizing for clean cookstoves. Asiko’s remarks emphasized the importance of the ACMI in accelerating climate action in Africa, projecting that the initiative could mobilize tens of billions of dollars for climate projects.

Our closing thoughts

The ACS and the Nairobi Declaration highlight that Africa will play a crucial role in addressing global change, and signals ownership from the continent to take action by fostering carbon projects, and restoring land and ecosystems to create carbon sinks. They also highlight the importance of partnerships and investments from other nations. The investments announced at the summit are a promising start, but constitute a small proportion of the total investment required in the continent on climate initiatives. The lack of investment belies the true extent of productive community-driven carbon projects on the ground.

The ACS has set the stage for collaborative action on climate change, and we look forward to being a part of this transformative journey. Stay tuned for more updates on how NetaCarbon is contributing to this evolving landscape of climate solutions!

#1 | Global carbon tax proposal

One of the headline-grabbing moments at ACS was the proposal by African countries for a global carbon tax. This would enable major polluters to support poor nations in financing the rollout of green energy systems, addressing an urgent need for climate financing, and redressing inequities between those contributing to carbon emissions and those affected by them. The proposal includes a carbon tax on fossil fuel trade, maritime transport, and aviation, which could be augmented by a global financial transaction tax (FTT), and would provide ring-fenced “affordable finance for climate positive investments at scale”, independent of geopolitical and national interests. The tax could raise an estimated $100bn each year, providing another avenue to support local climate projects.

“What we are saying is that we want to pay. We do not want to say ‘let those guys pay because they are the polluters’, we are saying, ‘let’s all pay’, and then let’s have a mechanism where we invest these resources where we unlock the biggest value on decarbonisation.”

— William Ruto, Kenyan President and Host of the ACS

Luis Tato/AFP via Getty Images

#2 | Announcements of major investments in the carbon market

There were many exciting announcements of investment in climate initiatives at the summit:

Investors from the UAE committed to buying $450m of carbon credits from the Africa Carbon Markets Initiative (ACMI), launched at the COP27 summit hosted in Egypt last summer

The U.S. announced key investments during the summit totalling $280m across multiple agencies including USAID, the U.S. International Development Finance Corporation (DFC), and the President’s Emergency Plan for Adaptation and Resilience (PREPARE) in Africa. This includes investments to help derisk carbon finance, fund carbon projects, support the Kenyan government to develop its carbon market activiatoin plan.

Climate Asset Management, a joint venture between HSBC and Pollination, a specialist climate investment firm, also announced a $200m investment in projects producing ACMI credits

According to the non-profit Climate Policy Initiative, Africa has only received about 12% of the money it needs to cope with climate impacts. These investments signal an increased commitment to climate resilience, and could catalyze the development of many carbon projects, but must be a foundation for further sustained investment.

#3 | Progress on the Africa Carbon Markets Initiative (ACMI)

William Asiko from the Rockefeller Foundation, co-creator of the ACMI, used the summit as a platform to share progress made by the ACMI since COP27. This includes:

Engagement with more than 20 countries, six of whom, including Kenya, are on the brink of starting work to develop their carbon market structure with the help of ACMI

Advanced Market Commitments of $200m for carbon credits by major global companies including Standard Chartered, Vertree, ETG, and Nando’s

Upcoming auctions on African carbon credits held by three major international exchanges and auction housesUpcoming collaboration on financial mechanisms with major financiers, including Standard Chartered, the African Development Bank, and FSD, to increase capital flows into carbon credit reduction projects

Drafting of the inaugural Carbon Credit Showcase, which will represent 92 projects from 63 developers across 23 countries

Underlying this progress was the message that they were at the beginning of the journey to fulfill carbon credit potential in Africa, presenting a significant unclaimed market opportunity. We have highlighted this opportunity ourselves in previous blog posts, such as the market sizing for clean cookstoves. Asiko’s remarks emphasized the importance of the ACMI in accelerating climate action in Africa, projecting that the initiative could mobilize tens of billions of dollars for climate projects.

Our closing thoughts

The ACS and the Nairobi Declaration highlight that Africa will play a crucial role in addressing global change, and signals ownership from the continent to take action by fostering carbon projects, and restoring land and ecosystems to create carbon sinks. They also highlight the importance of partnerships and investments from other nations. The investments announced at the summit are a promising start, but constitute a small proportion of the total investment required in the continent on climate initiatives. The lack of investment belies the true extent of productive community-driven carbon projects on the ground.

The ACS has set the stage for collaborative action on climate change, and we look forward to being a part of this transformative journey. Stay tuned for more updates on how NetaCarbon is contributing to this evolving landscape of climate solutions!

#1 | Global carbon tax proposal

One of the headline-grabbing moments at ACS was the proposal by African countries for a global carbon tax. This would enable major polluters to support poor nations in financing the rollout of green energy systems, addressing an urgent need for climate financing, and redressing inequities between those contributing to carbon emissions and those affected by them. The proposal includes a carbon tax on fossil fuel trade, maritime transport, and aviation, which could be augmented by a global financial transaction tax (FTT), and would provide ring-fenced “affordable finance for climate positive investments at scale”, independent of geopolitical and national interests. The tax could raise an estimated $100bn each year, providing another avenue to support local climate projects.

“What we are saying is that we want to pay. We do not want to say ‘let those guys pay because they are the polluters’, we are saying, ‘let’s all pay’, and then let’s have a mechanism where we invest these resources where we unlock the biggest value on decarbonisation.”

— William Ruto, Kenyan President and Host of the ACS

Luis Tato/AFP via Getty Images

#2 | Announcements of major investments in the carbon market

There were many exciting announcements of investment in climate initiatives at the summit:

Investors from the UAE committed to buying $450m of carbon credits from the Africa Carbon Markets Initiative (ACMI), launched at the COP27 summit hosted in Egypt last summer

The U.S. announced key investments during the summit totalling $280m across multiple agencies including USAID, the U.S. International Development Finance Corporation (DFC), and the President’s Emergency Plan for Adaptation and Resilience (PREPARE) in Africa. This includes investments to help derisk carbon finance, fund carbon projects, support the Kenyan government to develop its carbon market activiatoin plan.

Climate Asset Management, a joint venture between HSBC and Pollination, a specialist climate investment firm, also announced a $200m investment in projects producing ACMI credits

According to the non-profit Climate Policy Initiative, Africa has only received about 12% of the money it needs to cope with climate impacts. These investments signal an increased commitment to climate resilience, and could catalyze the development of many carbon projects, but must be a foundation for further sustained investment.

#3 | Progress on the Africa Carbon Markets Initiative (ACMI)

William Asiko from the Rockefeller Foundation, co-creator of the ACMI, used the summit as a platform to share progress made by the ACMI since COP27. This includes:

Engagement with more than 20 countries, six of whom, including Kenya, are on the brink of starting work to develop their carbon market structure with the help of ACMI

Advanced Market Commitments of $200m for carbon credits by major global companies including Standard Chartered, Vertree, ETG, and Nando’s

Upcoming auctions on African carbon credits held by three major international exchanges and auction housesUpcoming collaboration on financial mechanisms with major financiers, including Standard Chartered, the African Development Bank, and FSD, to increase capital flows into carbon credit reduction projects

Drafting of the inaugural Carbon Credit Showcase, which will represent 92 projects from 63 developers across 23 countries

Underlying this progress was the message that they were at the beginning of the journey to fulfill carbon credit potential in Africa, presenting a significant unclaimed market opportunity. We have highlighted this opportunity ourselves in previous blog posts, such as the market sizing for clean cookstoves. Asiko’s remarks emphasized the importance of the ACMI in accelerating climate action in Africa, projecting that the initiative could mobilize tens of billions of dollars for climate projects.

Our closing thoughts

The ACS and the Nairobi Declaration highlight that Africa will play a crucial role in addressing global change, and signals ownership from the continent to take action by fostering carbon projects, and restoring land and ecosystems to create carbon sinks. They also highlight the importance of partnerships and investments from other nations. The investments announced at the summit are a promising start, but constitute a small proportion of the total investment required in the continent on climate initiatives. The lack of investment belies the true extent of productive community-driven carbon projects on the ground.

The ACS has set the stage for collaborative action on climate change, and we look forward to being a part of this transformative journey. Stay tuned for more updates on how NetaCarbon is contributing to this evolving landscape of climate solutions!

Since you made it this far, why not sign up for our newsletter?

Since you made it this far, why not sign up for our newsletter?

See what's possible

Build your sustainable brand presence while investing in the planet together.

See what's possible

Build your sustainable brand presence while investing in the planet together.

See what's possible

Build your sustainable brand presence while investing in the planet together.

See what's possible

Build your sustainable brand presence while investing in the planet together.

Stay up to date

2024 NetaCarbon. All rights reserved.

Stay up to date

2024 NetaCarbon. All rights reserved.

Stay up to date

2024 NetaCarbon. All rights reserved.

Stay up to date

2024 NetaCarbon. All rights reserved.