EU Green Claims Directive: Reshaping Transparency in Environmental Labeling

EU Green Claims Directive: Reshaping Transparency in Environmental Labeling

EU Green Claims Directive: Reshaping Transparency in Environmental Labeling

KNOWLEDGE & INSIGHTS

October 22, 2024

Grace Lam

·

Co-Founder

Sandy Sun

·

Blog Contributor

As the European Union prepares to implement the Green Claims Directive in early 2026, businesses must ready themselves for a new era of environmental accountability. The Directive comes in response to the findings by the European Commission in 2020: 53% of examined environmental claims in the EU were vague, misleading, or unfounded, and 40% were unsubstantiated. By standardizing environmental labels and enhancing credibility to consumers across the EU market, this new regulation aims to combat greenwashing.

What is the EU Green Claims Directive?

The Directive will “set detailed rules on substantiating and communicating explicit environmental claims about products, in business-to-consumer commercial practices.” Understanding and adapting to the new rule is crucial for businesses selling products or services in the EU market, regardless of sales channel (offline or online) and size.

Our summary of the Directive is as follows:

Generic Claims: Terms like "eco-friendly", "climate-friendly", "ecological", or "biodegradable" are prohibited without verification from third-party verifiers accredited by the government.

Sustainability Substantiation: Sustainability labeling and any future sustainability performance claims must be supported with independent certification and verifiable implementation plans.

Carbon Neutrality: Claims based solely on purchasing carbon credits or offsetting emissions outside the production supply chain are banned.

Partial Claims: Environmental statements about an entire product or business that only apply to a specific aspect are prohibited, as well as claims that simply reflect compliance with legal requirements.

Reporting Transparency: Evidence to validate claims of environmental performance and disclosures about their use of carbon credits, including the type (removal vs. reduction), lifecycle, and certification standards, must be submitted.

How does this impact companies’ carbon credit usage & reporting?

The Directive introduces significant changes to the use and communication of carbon credits, fundamentally altering how companies approach offsetting. Under the new rules, only carbon removals, not emission reductions or avoidances, can be used for offsetting claims, and these must be certified under the EU Carbon Removal Certification Framework (CRCF). This shift aims to ensure that offsetting practices genuinely contribute to carbon reduction, rather than merely avoiding emissions.

Importantly, the Directive limits offsetting to residual emissions, encouraging businesses to prioritize direct emission reductions in their operations and supply chains. While it does not define “residual emission” directly, the SBTi net-zero standards typically refer to roughly 5-10% of a company's total emissions. To enhance transparency, companies are also required to separately report their GHG emissions and offsetting data, specifying whether offsets come from reductions or removals. This increased transparency extends to requiring more detailed disclosures about carbon credit usage.

Despite the anticipated benefits from rigorous carbon credit usage and reporting, the Directive still lacks specificity in certain areas, such as:

Lack of a robust, sector-specific definition for "residual emissions": This could lead to manipulation of boundaries between emissions that must be reduced and those that can be offset.

Lack of a clear framework on the types of emissions the carbon removal credits can compensate: This could potentially risk the offsetting of long-lived emissions through shorter-term carbon storage with higher reversal risks.

Focus on product-level claims, rather than company-level claims: This may create potential loopholes and a risk of double-counting carbon credits between voluntary markets and the EU’s nationally determined contributions (NDC).

Companies need to carefully review their carbon management and reporting strategies to ensure compliance and maintain credibility in their environmental claims. While the Directive represents a progressive step forward in regulating environmental claims, it is evident that some aspects require further refinement to close potential loopholes and ensure its effectiveness in achieving its intended goals.

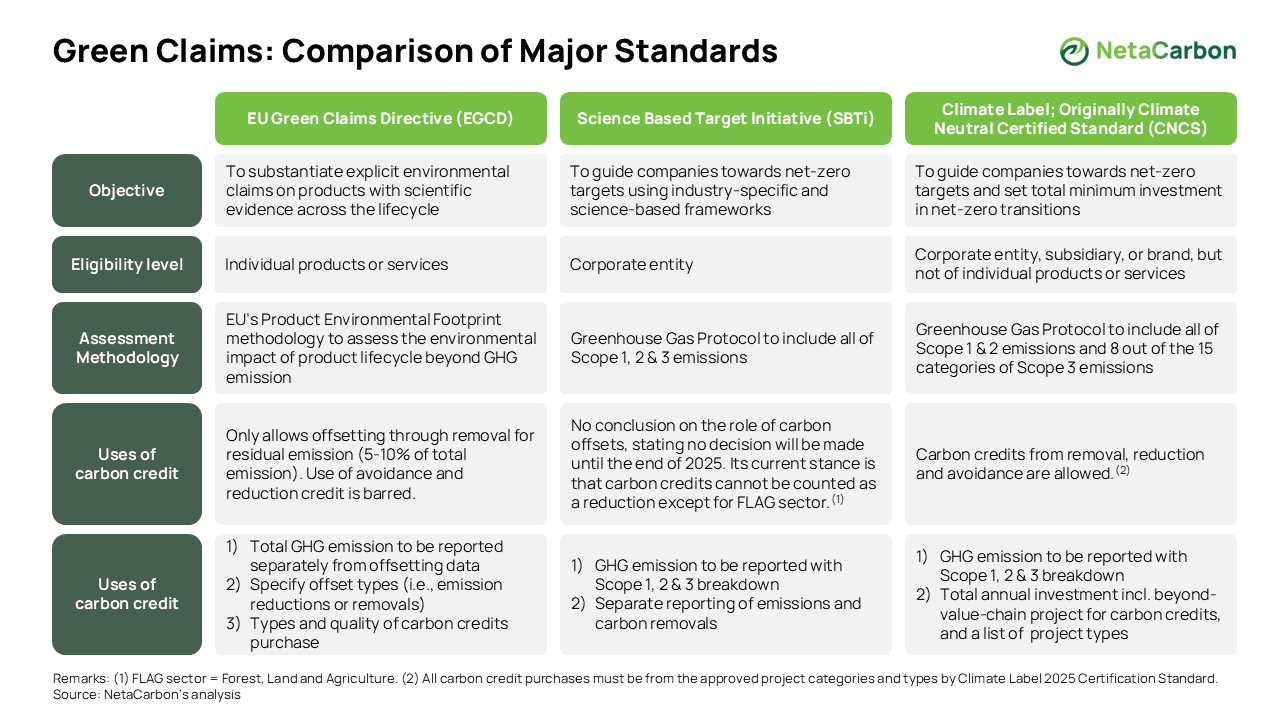

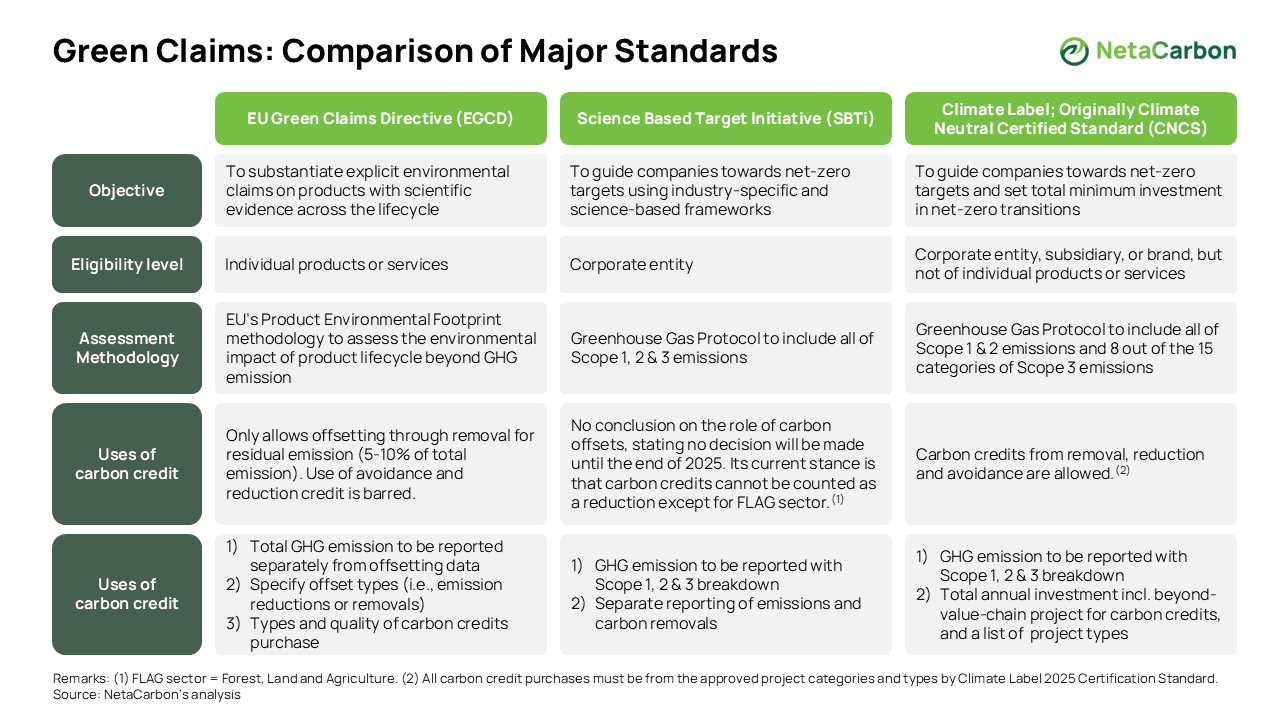

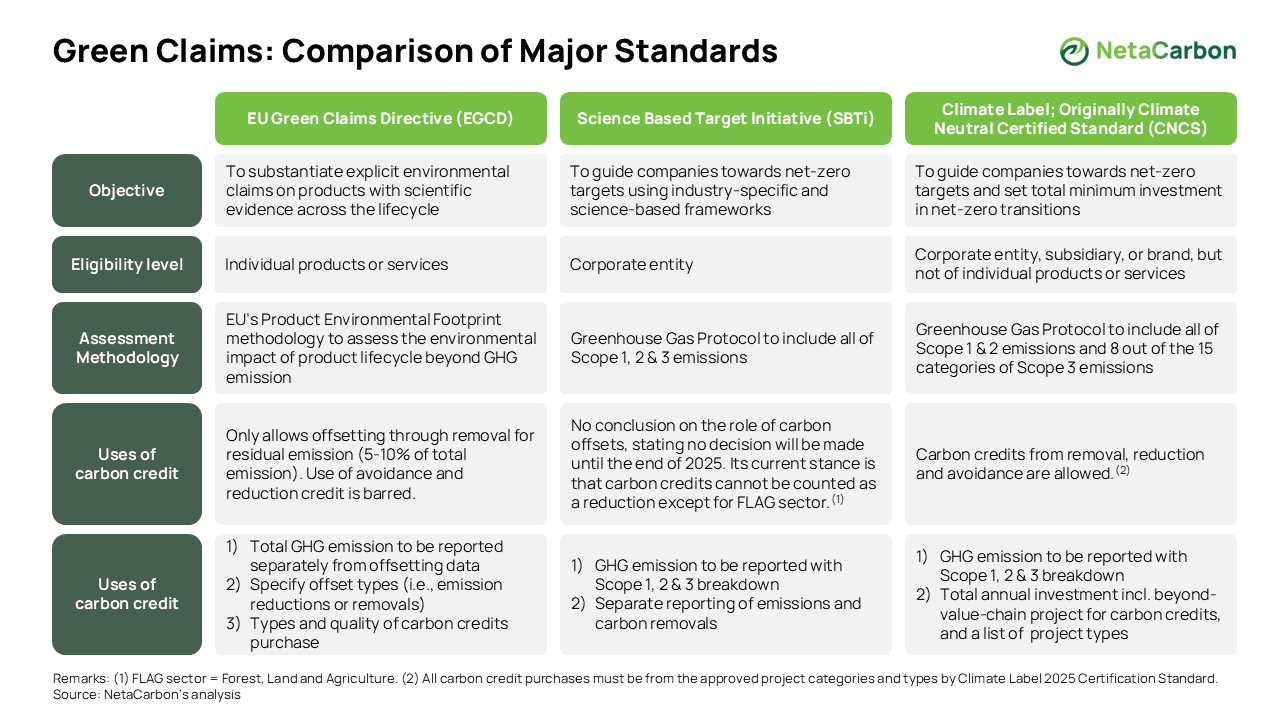

Green Claims: Comparison of Major Standards

There are many standards out there that guide corporations on how to set and manage their climate goals. These standards might be confusing to consumers and even sustainability officers on what these different claims represent and how the carbon market plays a role in it. In the below table, we compare how the EU Green Claim Directive fits into the frameworks of other popular sustainability standard frameworks:

Impacts and Implications on the Carbon Market

The Directive will present both challenges and opportunities to businesses, project developers, and third-party verifiers. Corporations will need to prepare for detailed environmental disclosures with robust data collection and reporting systems. They will also need to prioritize in-house emission reduction, transitioning from reliance on offsetting mechanisms.

The potential to build stronger consumer trust, driving demand for sustainable products, should be balanced with concerns about "greenhushing" – companies becoming overly cautious about making any environmental claims due to fear of regulatory scrutiny. Compliance costs, including investments in data systems, verification, and potential rebranding, may be significant, particularly for smaller businesses.

For project developers, the Directive will redirect EU-based buyers from avoidance or reduction projects toward removal projects, such as direct air capture and reforestation. Project developers will need to align with new CRCF standards for carbon credits, potentially incurring higher costs for verification and certification. However, these higher-quality credits offer an opportunity for differentiation and encourage greater investment in sophisticated monitoring, reporting, and verification (MRV) technologies.

On a bright note, those who adapt quickly and transparently will be well-positioned to differentiate themselves in an increasingly eco-aware market. The Directive thus offers an opportunity for consumer businesses active in the EU market to lead in sustainability practices, driving innovation and setting new industry standards.

What is the EU Green Claims Directive?

The Directive will “set detailed rules on substantiating and communicating explicit environmental claims about products, in business-to-consumer commercial practices.” Understanding and adapting to the new rule is crucial for businesses selling products or services in the EU market, regardless of sales channel (offline or online) and size.

Our summary of the Directive is as follows:

Generic Claims: Terms like "eco-friendly", "climate-friendly", "ecological", or "biodegradable" are prohibited without verification from third-party verifiers accredited by the government.

Sustainability Substantiation: Sustainability labeling and any future sustainability performance claims must be supported with independent certification and verifiable implementation plans.

Carbon Neutrality: Claims based solely on purchasing carbon credits or offsetting emissions outside the production supply chain are banned.

Partial Claims: Environmental statements about an entire product or business that only apply to a specific aspect are prohibited, as well as claims that simply reflect compliance with legal requirements.

Reporting Transparency: Evidence to validate claims of environmental performance and disclosures about their use of carbon credits, including the type (removal vs. reduction), lifecycle, and certification standards, must be submitted.

How does this impact companies’ carbon credit usage & reporting?

The Directive introduces significant changes to the use and communication of carbon credits, fundamentally altering how companies approach offsetting. Under the new rules, only carbon removals, not emission reductions or avoidances, can be used for offsetting claims, and these must be certified under the EU Carbon Removal Certification Framework (CRCF). This shift aims to ensure that offsetting practices genuinely contribute to carbon reduction, rather than merely avoiding emissions.

Importantly, the Directive limits offsetting to residual emissions, encouraging businesses to prioritize direct emission reductions in their operations and supply chains. While it does not define “residual emission” directly, the SBTi net-zero standards typically refer to roughly 5-10% of a company's total emissions. To enhance transparency, companies are also required to separately report their GHG emissions and offsetting data, specifying whether offsets come from reductions or removals. This increased transparency extends to requiring more detailed disclosures about carbon credit usage.

Despite the anticipated benefits from rigorous carbon credit usage and reporting, the Directive still lacks specificity in certain areas, such as:

Lack of a robust, sector-specific definition for "residual emissions": This could lead to manipulation of boundaries between emissions that must be reduced and those that can be offset.

Lack of a clear framework on the types of emissions the carbon removal credits can compensate: This could potentially risk the offsetting of long-lived emissions through shorter-term carbon storage with higher reversal risks.

Focus on product-level claims, rather than company-level claims: This may create potential loopholes and a risk of double-counting carbon credits between voluntary markets and the EU’s nationally determined contributions (NDC).

Companies need to carefully review their carbon management and reporting strategies to ensure compliance and maintain credibility in their environmental claims. While the Directive represents a progressive step forward in regulating environmental claims, it is evident that some aspects require further refinement to close potential loopholes and ensure its effectiveness in achieving its intended goals.

Green Claims: Comparison of Major Standards

There are many standards out there that guide corporations on how to set and manage their climate goals. These standards might be confusing to consumers and even sustainability officers on what these different claims represent and how the carbon market plays a role in it. In the below table, we compare how the EU Green Claim Directive fits into the frameworks of other popular sustainability standard frameworks:

Impacts and Implications on the Carbon Market

The Directive will present both challenges and opportunities to businesses, project developers, and third-party verifiers. Corporations will need to prepare for detailed environmental disclosures with robust data collection and reporting systems. They will also need to prioritize in-house emission reduction, transitioning from reliance on offsetting mechanisms.

The potential to build stronger consumer trust, driving demand for sustainable products, should be balanced with concerns about "greenhushing" – companies becoming overly cautious about making any environmental claims due to fear of regulatory scrutiny. Compliance costs, including investments in data systems, verification, and potential rebranding, may be significant, particularly for smaller businesses.

For project developers, the Directive will redirect EU-based buyers from avoidance or reduction projects toward removal projects, such as direct air capture and reforestation. Project developers will need to align with new CRCF standards for carbon credits, potentially incurring higher costs for verification and certification. However, these higher-quality credits offer an opportunity for differentiation and encourage greater investment in sophisticated monitoring, reporting, and verification (MRV) technologies.

On a bright note, those who adapt quickly and transparently will be well-positioned to differentiate themselves in an increasingly eco-aware market. The Directive thus offers an opportunity for consumer businesses active in the EU market to lead in sustainability practices, driving innovation and setting new industry standards.

What is the EU Green Claims Directive?

The Directive will “set detailed rules on substantiating and communicating explicit environmental claims about products, in business-to-consumer commercial practices.” Understanding and adapting to the new rule is crucial for businesses selling products or services in the EU market, regardless of sales channel (offline or online) and size.

Our summary of the Directive is as follows:

Generic Claims: Terms like "eco-friendly", "climate-friendly", "ecological", or "biodegradable" are prohibited without verification from third-party verifiers accredited by the government.

Sustainability Substantiation: Sustainability labeling and any future sustainability performance claims must be supported with independent certification and verifiable implementation plans.

Carbon Neutrality: Claims based solely on purchasing carbon credits or offsetting emissions outside the production supply chain are banned.

Partial Claims: Environmental statements about an entire product or business that only apply to a specific aspect are prohibited, as well as claims that simply reflect compliance with legal requirements.

Reporting Transparency: Evidence to validate claims of environmental performance and disclosures about their use of carbon credits, including the type (removal vs. reduction), lifecycle, and certification standards, must be submitted.

How does this impact companies’ carbon credit usage & reporting?

The Directive introduces significant changes to the use and communication of carbon credits, fundamentally altering how companies approach offsetting. Under the new rules, only carbon removals, not emission reductions or avoidances, can be used for offsetting claims, and these must be certified under the EU Carbon Removal Certification Framework (CRCF). This shift aims to ensure that offsetting practices genuinely contribute to carbon reduction, rather than merely avoiding emissions.

Importantly, the Directive limits offsetting to residual emissions, encouraging businesses to prioritize direct emission reductions in their operations and supply chains. While it does not define “residual emission” directly, the SBTi net-zero standards typically refer to roughly 5-10% of a company's total emissions. To enhance transparency, companies are also required to separately report their GHG emissions and offsetting data, specifying whether offsets come from reductions or removals. This increased transparency extends to requiring more detailed disclosures about carbon credit usage.

Despite the anticipated benefits from rigorous carbon credit usage and reporting, the Directive still lacks specificity in certain areas, such as:

Lack of a robust, sector-specific definition for "residual emissions": This could lead to manipulation of boundaries between emissions that must be reduced and those that can be offset.

Lack of a clear framework on the types of emissions the carbon removal credits can compensate: This could potentially risk the offsetting of long-lived emissions through shorter-term carbon storage with higher reversal risks.

Focus on product-level claims, rather than company-level claims: This may create potential loopholes and a risk of double-counting carbon credits between voluntary markets and the EU’s nationally determined contributions (NDC).

Companies need to carefully review their carbon management and reporting strategies to ensure compliance and maintain credibility in their environmental claims. While the Directive represents a progressive step forward in regulating environmental claims, it is evident that some aspects require further refinement to close potential loopholes and ensure its effectiveness in achieving its intended goals.

Green Claims: Comparison of Major Standards

There are many standards out there that guide corporations on how to set and manage their climate goals. These standards might be confusing to consumers and even sustainability officers on what these different claims represent and how the carbon market plays a role in it. In the below table, we compare how the EU Green Claim Directive fits into the frameworks of other popular sustainability standard frameworks:

Impacts and Implications on the Carbon Market

The Directive will present both challenges and opportunities to businesses, project developers, and third-party verifiers. Corporations will need to prepare for detailed environmental disclosures with robust data collection and reporting systems. They will also need to prioritize in-house emission reduction, transitioning from reliance on offsetting mechanisms.

The potential to build stronger consumer trust, driving demand for sustainable products, should be balanced with concerns about "greenhushing" – companies becoming overly cautious about making any environmental claims due to fear of regulatory scrutiny. Compliance costs, including investments in data systems, verification, and potential rebranding, may be significant, particularly for smaller businesses.

For project developers, the Directive will redirect EU-based buyers from avoidance or reduction projects toward removal projects, such as direct air capture and reforestation. Project developers will need to align with new CRCF standards for carbon credits, potentially incurring higher costs for verification and certification. However, these higher-quality credits offer an opportunity for differentiation and encourage greater investment in sophisticated monitoring, reporting, and verification (MRV) technologies.

On a bright note, those who adapt quickly and transparently will be well-positioned to differentiate themselves in an increasingly eco-aware market. The Directive thus offers an opportunity for consumer businesses active in the EU market to lead in sustainability practices, driving innovation and setting new industry standards.

Since you made it this far, why not sign up for our newsletter?

Since you made it this far, why not sign up for our newsletter?

Make smarter

packaging decisions

See how we can cut your time spent on packaging compliance and data tracking by half

Make smarter

packaging decisions

See how we can cut your time spent on packaging compliance and data tracking by half

Make smarter

packaging decisions

See how we can cut your time spent on packaging compliance and data tracking by half