Carbon insetting vs. offsetting: How does it work?

Carbon insetting vs. offsetting: How does it work?

Carbon insetting vs. offsetting: How does it work?

KNOWLEDGE & INSIGHTS

July 25, 2024

Grace Lam

·

Co-founder

Mar Velasco

·

Co-founder

With over half of the world’s largest publicly-listed companies committed to achieving net zero emissions by 2050, there is a significant push to explore solutions to address residual or scope 3 emissions. This demand has led to a growing interest in carbon insetting — this approach involves decarbonization efforts within a company’s value chain by implementing nature-based carbon projects.

Unlike traditional carbon credits, which rely on third parties to offset a company’s direct and indirect emissions through external projects, carbon insets focus on reducing emissions within the company’s own supply chain. Many companies have already embraced insetting, with major brands such as Nestlé, PepsiCo, and L’Oréal pioneering the way. We see a rising momentum for more companies to start exploring insetting in the future.

What is Carbon Insetting?

The International Platform for Insetting (IPI) defines insetting as the implementation of interventions along a company’s value chain designed to generate GHG emission reductions and carbon storage.” This means that companies will take initiatives within their own operations and supply chain to cut down on greenhouse gases and capture carbon.

Carbon insetting addresses Scope 3 emissions, meaning emissions from activities from assets not owned or controlled by the company, but that the organization indirectly affects in its value chain. These emissions typically compose the majority of a company's total GHG emissions, so reducing and removing them has a significant impact on the environment. In addition, these projects also tend to benefit local communities, ecosystems, and landscapes by providing new jobs and enhancing biodiversity.

The steps a company takes to carbon inset begin with identifying the part of its supply chain that is the biggest contributor to carbon emissions. Based on the corresponding sector, the company can then choose to implement a wide range of projects to address these emissions, including reforestation, regenerative agriculture, and investing in renewable energy sources for their operations.

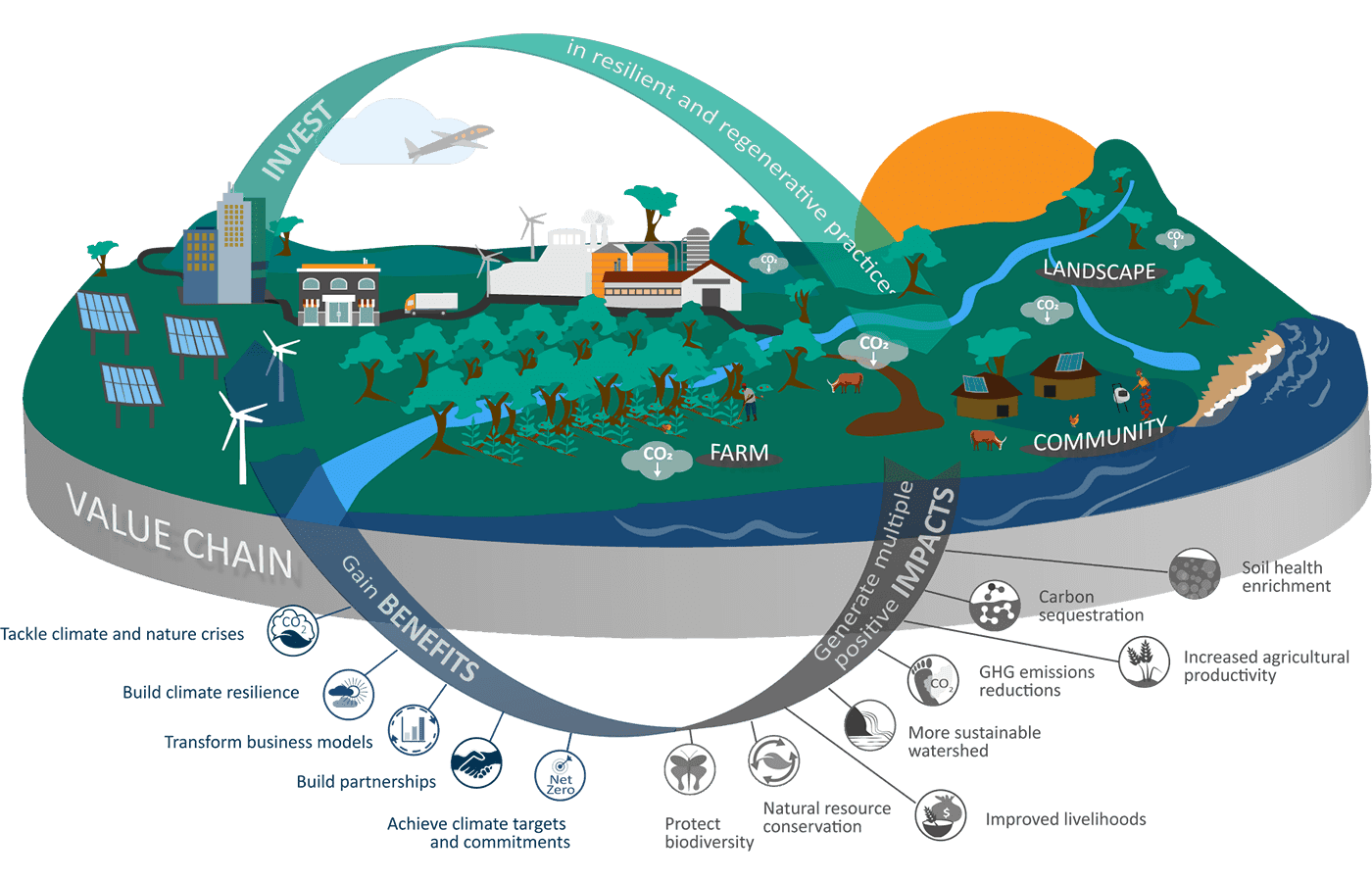

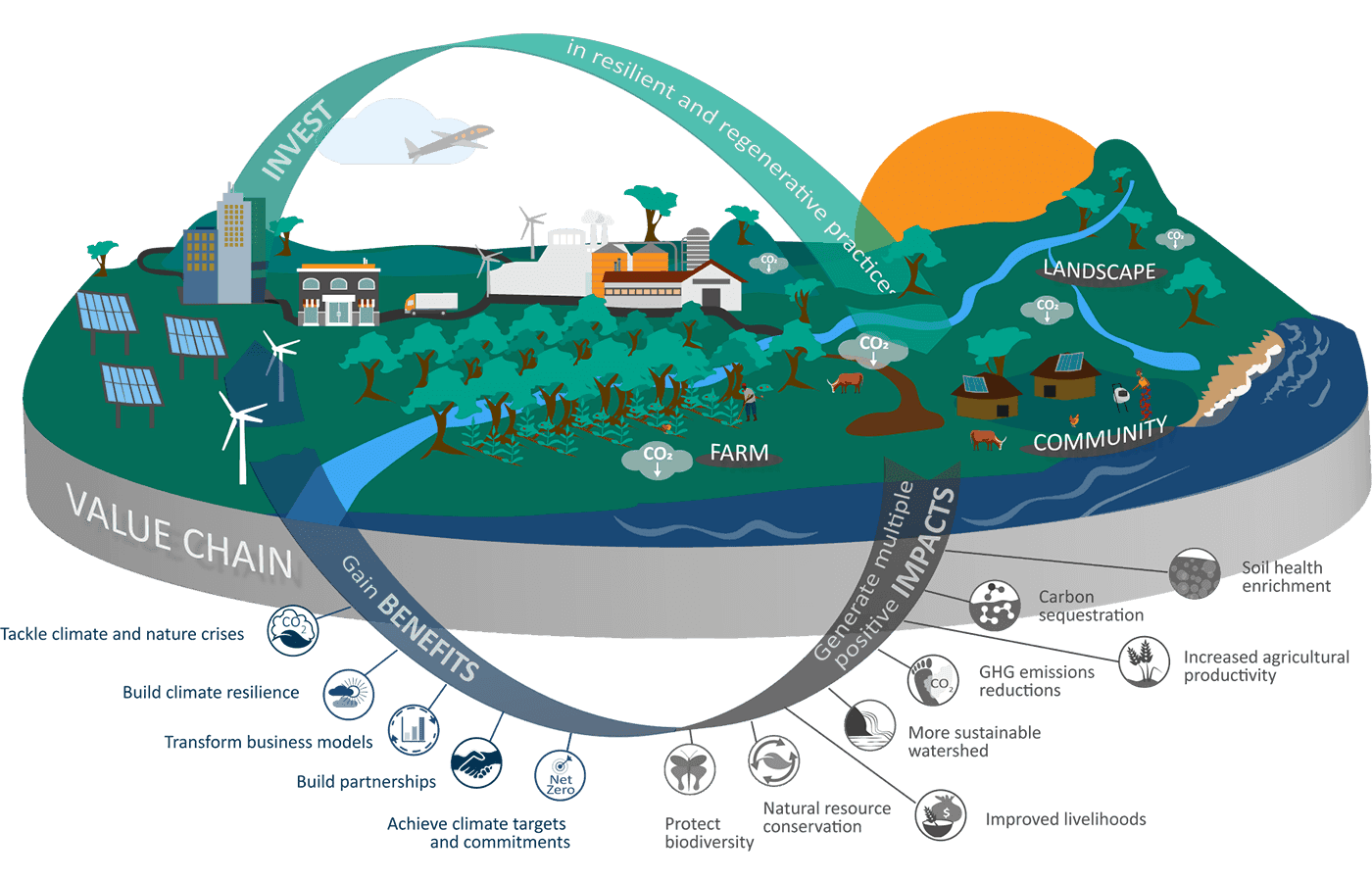

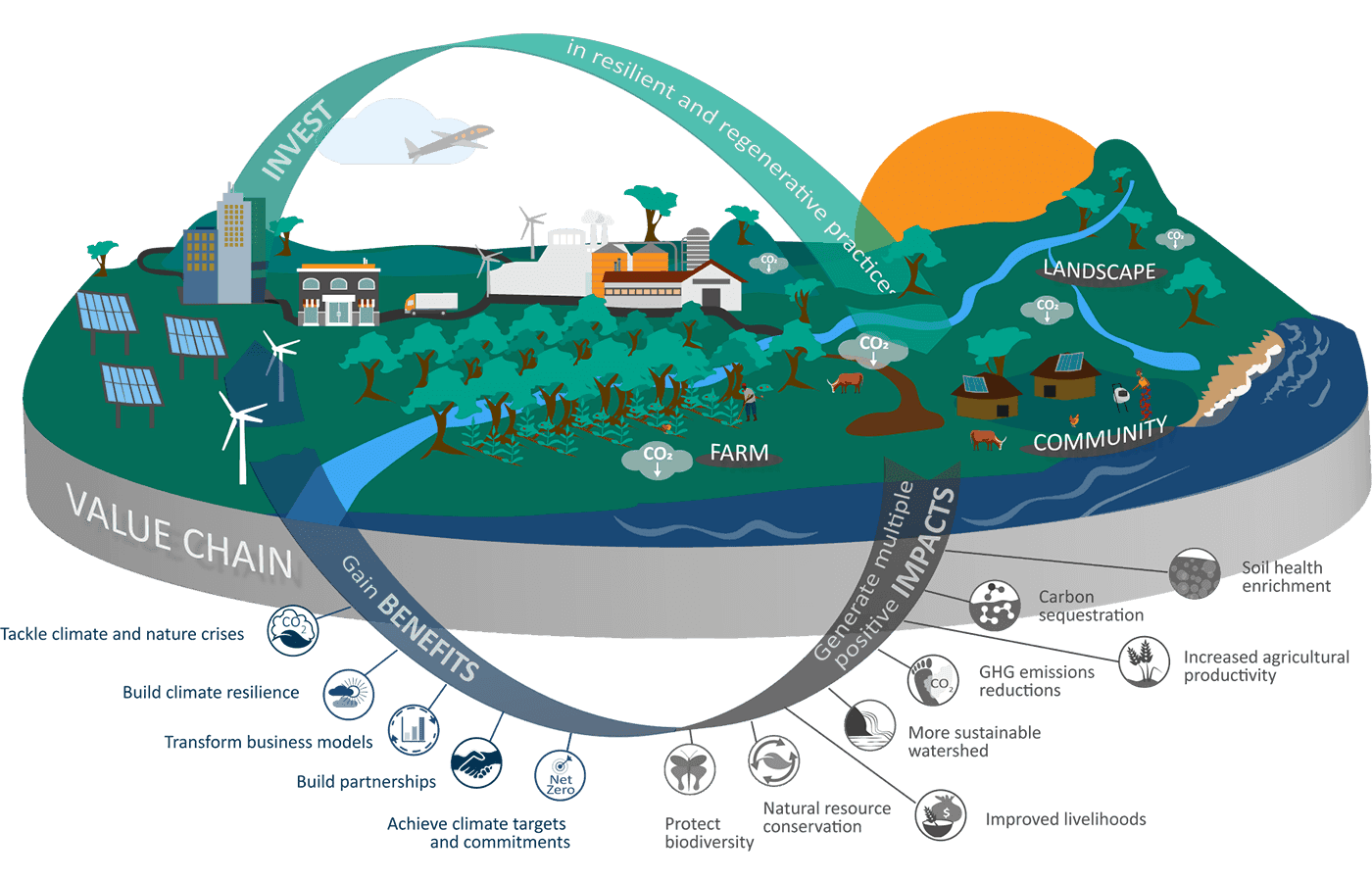

Insetting projects generate climate and community benefits within companies’ value chain and help companies reach their climate targets. (Source: International Platform for Insetting)

Carbon Insetting vs Carbon Offsetting

While carbon insetting and offsetting are both ways companies can reduce their carbon footprint, the benefits they provide differ in their scope and location.

One of the biggest differences between the two approaches is that carbon offsetting allows companies to invest in projects they do not own or operate, whereas carbon insetting involves funding their own carbon removal or avoidance projects within their supply chain, without engaging in the carbon market. As a result, carbon insetting might require more time and legal work since the company itself is creating and developing the projects, whereas purchasing carbon offsets is usually a much quicker way for companies to reduce their GHG emissions, since they can purchase carbon credits instantly through carbon markets. Companies might opt for carbon offsets during the early stages of their sustainability journeys.

Furthermore, the carbon offset mechanism is more established with multiple regulatory, verification, and certification bodies dedicated to ensuring the quality and transparency of carbon credits used to offset corporate emissions. Carbon insets, in part due to their novelty and their inherent design, currently do not have strict requirements for independent verification. Nevertheless, there is a growing movement towards improving the verification of these projects, as well as more international recognition of carbon insetting by emission regulatory bodies.

Due to the local and intercompany focus of carbon insets, they also tend to place a bigger emphasis on local co-benefits, for communities and ecosystems. This stems from the fact that project investments yield direct positive impacts on the value chain and the final product. This creates an incentive for companies to seek non-climate benefits, such as improved biodiversity or improved livelihoods, which will increase the value of their products.

Regulation Landscape of Carbon Insetting

Given how new the “insetting” concept is, there is currently very little governance and regulations around this market. Founded in 2013, the International Platform for Insetting (IPI) is the only organization solely dedicated to carbon insetting. The IPI provides guidance to companies on how to develop effective insetting projects. Their Insetting Program Standard, published in 2017, outlines the required steps for a successful insetting project, both in terms of a company’s management of the project as well as its outcomes. This standard allows insetting programs to be certified by a third party. In 2022, the IPI released an Insetting Guide that shares insights and provides recommendations from insetting practitioners on how companies with net zero targets can utilize insetting’s full potential.

In 2023, the Science Based Target initiative (SBTi), one of the largest and most trusted organizations for net zero corporate targets, updated its guidelines to include a form of insetting as a method to decarbonize for companies in the forestry, land, and agriculture (FLAG) sector. This will likely prompt many consumer-facing companies, whose GHG emissions largely consist of FLAG emissions, to begin pursuing carbon insetting initiatives.

Even though a global standard for verification and certification of carbon insetting projects is currently in development, thus making verifying carbon insets optional for companies, many choose to still verify their projects through third-party bodies, such as Verra and Gold standard.

How have Carbon Insets been used?

Carbon insets have been used by a number of large companies as a way to decarbonize their supply chains. For example, in the food and agriculture industry, Scope 3 emissions represent the majority of a consumer-facing company’s total greenhouse gas (GHG) emissions.

Nespresso, a Nestlé subsidiary, has been one of the leaders in the sector and has invested over $600 million in its agroforestry practices in Africa and Latin America. Between 2014 and 2023, Nespresso and its partners have planted more than 9 million trees, 6.9 million of which are expected to contribute to carbon removal over their lifetime, according to Nespresso’s Road to Net Zero.

PepsiCo and Walmart have also implemented ambitious insetting initiatives involving regenerative agriculture, and recently announced their joint commitment to supporting regenerative agriculture across more than 2 million acres of farmland, which is predicted to lower GHG emissions by approximately four million metric tons by 2030.

In the cosmetics industry, L’Oréal has facilitated the transition to improved cook stoves in West Africa that require less wood consumption when boiling shea nuts, a major ingredient in many L’Oréal products. Not only has this project in Burkina Faso prevented deforestation and cut GHG emissions, but it also has improved local livelihoods by reducing unpaid domestic work by the female workers, primarily spent preparing meals and collecting wood.

Implications

A more holistic approach to addressing residual emissions

The rise of carbon insets—which offer multifaceted benefits to communities and ecosystems across a company’s supply chain—reflects a shift to a more holistic approach to emission reductions. As companies shift away from purely GHG emission reductions and embrace a more comprehensive sustainability strategy to reach their net zero goals, it is expected that a rise in demand for projects with non-climate local benefits to follow. While companies should prioritize decarbonizing their internal operations, industry leaders are beginning to consider how insetting plays a role in their strategy, particularly in addressing their residual emissions.

Demand shifts from generic offsets to tailored insetting projects

Carbon insets also show that many organizations are searching for more agency on their road to net zero. By choosing to invest in projects within their own supply chain (rather than outsourcing emission reductions to third parties), companies can monitor and oversee their emission reduction efforts more diligently. This is in part driven by the recent controversies in the carbon market surrounding low-quality credits, which has made many companies weary of unknowingly investing in low-quality carbon projects. For carbon project developers, this might indicate a broader shift toward tailored projects and a reduced appetite for existing carbon credits. However, this also represents a growing opportunity for developers to collaborate with companies to develop high-quality insetting projects within their value chain.

Need for adequate regulations and monitoring

As of now, however, many of the concerns around offsets—namely, non-additionality and double-counting—might also apply to insets. This is largely because of the difficulties in accurate regulation around carbon offsetting and insetting projects alike. While the monitoring and verification of carbon offsets already prove to be challenging, this is even harder to enforce for insetting projects, which are conducted by companies themselves and are not required to be validated by an external registry or organization. This poses a risk to the development of low-quality projects that fail to achieve the original net zero targets set out by companies.

Despite the challenges and struggles with proper verification and accounting of carbon insets and offsets, it is crucial to recognize that all efforts towards achieving a net-zero economy are essential. In order to limit global warming to 1.5°C, as outlined in the Paris Agreement, we need to do everything we can, including aggressive decarbonization and utilizing carbon insets and carbon offsets alike, to collectively save our planet.

-

Are you an organization looking to develop your insetting strategy, or a carbon project developer looking to partner with organizations and create insetting projects? Please get in touch – we would love to speak!

What is Carbon Insetting?

The International Platform for Insetting (IPI) defines insetting as the implementation of interventions along a company’s value chain designed to generate GHG emission reductions and carbon storage.” This means that companies will take initiatives within their own operations and supply chain to cut down on greenhouse gases and capture carbon.

Carbon insetting addresses Scope 3 emissions, meaning emissions from activities from assets not owned or controlled by the company, but that the organization indirectly affects in its value chain. These emissions typically compose the majority of a company's total GHG emissions, so reducing and removing them has a significant impact on the environment. In addition, these projects also tend to benefit local communities, ecosystems, and landscapes by providing new jobs and enhancing biodiversity.

The steps a company takes to carbon inset begin with identifying the part of its supply chain that is the biggest contributor to carbon emissions. Based on the corresponding sector, the company can then choose to implement a wide range of projects to address these emissions, including reforestation, regenerative agriculture, and investing in renewable energy sources for their operations.

Insetting projects generate climate and community benefits within companies’ value chain and help companies reach their climate targets. (Source: International Platform for Insetting)

Carbon Insetting vs Carbon Offsetting

While carbon insetting and offsetting are both ways companies can reduce their carbon footprint, the benefits they provide differ in their scope and location.

One of the biggest differences between the two approaches is that carbon offsetting allows companies to invest in projects they do not own or operate, whereas carbon insetting involves funding their own carbon removal or avoidance projects within their supply chain, without engaging in the carbon market. As a result, carbon insetting might require more time and legal work since the company itself is creating and developing the projects, whereas purchasing carbon offsets is usually a much quicker way for companies to reduce their GHG emissions, since they can purchase carbon credits instantly through carbon markets. Companies might opt for carbon offsets during the early stages of their sustainability journeys.

Furthermore, the carbon offset mechanism is more established with multiple regulatory, verification, and certification bodies dedicated to ensuring the quality and transparency of carbon credits used to offset corporate emissions. Carbon insets, in part due to their novelty and their inherent design, currently do not have strict requirements for independent verification. Nevertheless, there is a growing movement towards improving the verification of these projects, as well as more international recognition of carbon insetting by emission regulatory bodies.

Due to the local and intercompany focus of carbon insets, they also tend to place a bigger emphasis on local co-benefits, for communities and ecosystems. This stems from the fact that project investments yield direct positive impacts on the value chain and the final product. This creates an incentive for companies to seek non-climate benefits, such as improved biodiversity or improved livelihoods, which will increase the value of their products.

Regulation Landscape of Carbon Insetting

Given how new the “insetting” concept is, there is currently very little governance and regulations around this market. Founded in 2013, the International Platform for Insetting (IPI) is the only organization solely dedicated to carbon insetting. The IPI provides guidance to companies on how to develop effective insetting projects. Their Insetting Program Standard, published in 2017, outlines the required steps for a successful insetting project, both in terms of a company’s management of the project as well as its outcomes. This standard allows insetting programs to be certified by a third party. In 2022, the IPI released an Insetting Guide that shares insights and provides recommendations from insetting practitioners on how companies with net zero targets can utilize insetting’s full potential.

In 2023, the Science Based Target initiative (SBTi), one of the largest and most trusted organizations for net zero corporate targets, updated its guidelines to include a form of insetting as a method to decarbonize for companies in the forestry, land, and agriculture (FLAG) sector. This will likely prompt many consumer-facing companies, whose GHG emissions largely consist of FLAG emissions, to begin pursuing carbon insetting initiatives.

Even though a global standard for verification and certification of carbon insetting projects is currently in development, thus making verifying carbon insets optional for companies, many choose to still verify their projects through third-party bodies, such as Verra and Gold standard.

How have Carbon Insets been used?

Carbon insets have been used by a number of large companies as a way to decarbonize their supply chains. For example, in the food and agriculture industry, Scope 3 emissions represent the majority of a consumer-facing company’s total greenhouse gas (GHG) emissions.

Nespresso, a Nestlé subsidiary, has been one of the leaders in the sector and has invested over $600 million in its agroforestry practices in Africa and Latin America. Between 2014 and 2023, Nespresso and its partners have planted more than 9 million trees, 6.9 million of which are expected to contribute to carbon removal over their lifetime, according to Nespresso’s Road to Net Zero.

PepsiCo and Walmart have also implemented ambitious insetting initiatives involving regenerative agriculture, and recently announced their joint commitment to supporting regenerative agriculture across more than 2 million acres of farmland, which is predicted to lower GHG emissions by approximately four million metric tons by 2030.

In the cosmetics industry, L’Oréal has facilitated the transition to improved cook stoves in West Africa that require less wood consumption when boiling shea nuts, a major ingredient in many L’Oréal products. Not only has this project in Burkina Faso prevented deforestation and cut GHG emissions, but it also has improved local livelihoods by reducing unpaid domestic work by the female workers, primarily spent preparing meals and collecting wood.

Implications

A more holistic approach to addressing residual emissions

The rise of carbon insets—which offer multifaceted benefits to communities and ecosystems across a company’s supply chain—reflects a shift to a more holistic approach to emission reductions. As companies shift away from purely GHG emission reductions and embrace a more comprehensive sustainability strategy to reach their net zero goals, it is expected that a rise in demand for projects with non-climate local benefits to follow. While companies should prioritize decarbonizing their internal operations, industry leaders are beginning to consider how insetting plays a role in their strategy, particularly in addressing their residual emissions.

Demand shifts from generic offsets to tailored insetting projects

Carbon insets also show that many organizations are searching for more agency on their road to net zero. By choosing to invest in projects within their own supply chain (rather than outsourcing emission reductions to third parties), companies can monitor and oversee their emission reduction efforts more diligently. This is in part driven by the recent controversies in the carbon market surrounding low-quality credits, which has made many companies weary of unknowingly investing in low-quality carbon projects. For carbon project developers, this might indicate a broader shift toward tailored projects and a reduced appetite for existing carbon credits. However, this also represents a growing opportunity for developers to collaborate with companies to develop high-quality insetting projects within their value chain.

Need for adequate regulations and monitoring

As of now, however, many of the concerns around offsets—namely, non-additionality and double-counting—might also apply to insets. This is largely because of the difficulties in accurate regulation around carbon offsetting and insetting projects alike. While the monitoring and verification of carbon offsets already prove to be challenging, this is even harder to enforce for insetting projects, which are conducted by companies themselves and are not required to be validated by an external registry or organization. This poses a risk to the development of low-quality projects that fail to achieve the original net zero targets set out by companies.

Despite the challenges and struggles with proper verification and accounting of carbon insets and offsets, it is crucial to recognize that all efforts towards achieving a net-zero economy are essential. In order to limit global warming to 1.5°C, as outlined in the Paris Agreement, we need to do everything we can, including aggressive decarbonization and utilizing carbon insets and carbon offsets alike, to collectively save our planet.

-

Are you an organization looking to develop your insetting strategy, or a carbon project developer looking to partner with organizations and create insetting projects? Please get in touch – we would love to speak!

What is Carbon Insetting?

The International Platform for Insetting (IPI) defines insetting as the implementation of interventions along a company’s value chain designed to generate GHG emission reductions and carbon storage.” This means that companies will take initiatives within their own operations and supply chain to cut down on greenhouse gases and capture carbon.

Carbon insetting addresses Scope 3 emissions, meaning emissions from activities from assets not owned or controlled by the company, but that the organization indirectly affects in its value chain. These emissions typically compose the majority of a company's total GHG emissions, so reducing and removing them has a significant impact on the environment. In addition, these projects also tend to benefit local communities, ecosystems, and landscapes by providing new jobs and enhancing biodiversity.

The steps a company takes to carbon inset begin with identifying the part of its supply chain that is the biggest contributor to carbon emissions. Based on the corresponding sector, the company can then choose to implement a wide range of projects to address these emissions, including reforestation, regenerative agriculture, and investing in renewable energy sources for their operations.

Insetting projects generate climate and community benefits within companies’ value chain and help companies reach their climate targets. (Source: International Platform for Insetting)

Carbon Insetting vs Carbon Offsetting

While carbon insetting and offsetting are both ways companies can reduce their carbon footprint, the benefits they provide differ in their scope and location.

One of the biggest differences between the two approaches is that carbon offsetting allows companies to invest in projects they do not own or operate, whereas carbon insetting involves funding their own carbon removal or avoidance projects within their supply chain, without engaging in the carbon market. As a result, carbon insetting might require more time and legal work since the company itself is creating and developing the projects, whereas purchasing carbon offsets is usually a much quicker way for companies to reduce their GHG emissions, since they can purchase carbon credits instantly through carbon markets. Companies might opt for carbon offsets during the early stages of their sustainability journeys.

Furthermore, the carbon offset mechanism is more established with multiple regulatory, verification, and certification bodies dedicated to ensuring the quality and transparency of carbon credits used to offset corporate emissions. Carbon insets, in part due to their novelty and their inherent design, currently do not have strict requirements for independent verification. Nevertheless, there is a growing movement towards improving the verification of these projects, as well as more international recognition of carbon insetting by emission regulatory bodies.

Due to the local and intercompany focus of carbon insets, they also tend to place a bigger emphasis on local co-benefits, for communities and ecosystems. This stems from the fact that project investments yield direct positive impacts on the value chain and the final product. This creates an incentive for companies to seek non-climate benefits, such as improved biodiversity or improved livelihoods, which will increase the value of their products.

Regulation Landscape of Carbon Insetting

Given how new the “insetting” concept is, there is currently very little governance and regulations around this market. Founded in 2013, the International Platform for Insetting (IPI) is the only organization solely dedicated to carbon insetting. The IPI provides guidance to companies on how to develop effective insetting projects. Their Insetting Program Standard, published in 2017, outlines the required steps for a successful insetting project, both in terms of a company’s management of the project as well as its outcomes. This standard allows insetting programs to be certified by a third party. In 2022, the IPI released an Insetting Guide that shares insights and provides recommendations from insetting practitioners on how companies with net zero targets can utilize insetting’s full potential.

In 2023, the Science Based Target initiative (SBTi), one of the largest and most trusted organizations for net zero corporate targets, updated its guidelines to include a form of insetting as a method to decarbonize for companies in the forestry, land, and agriculture (FLAG) sector. This will likely prompt many consumer-facing companies, whose GHG emissions largely consist of FLAG emissions, to begin pursuing carbon insetting initiatives.

Even though a global standard for verification and certification of carbon insetting projects is currently in development, thus making verifying carbon insets optional for companies, many choose to still verify their projects through third-party bodies, such as Verra and Gold standard.

How have Carbon Insets been used?

Carbon insets have been used by a number of large companies as a way to decarbonize their supply chains. For example, in the food and agriculture industry, Scope 3 emissions represent the majority of a consumer-facing company’s total greenhouse gas (GHG) emissions.

Nespresso, a Nestlé subsidiary, has been one of the leaders in the sector and has invested over $600 million in its agroforestry practices in Africa and Latin America. Between 2014 and 2023, Nespresso and its partners have planted more than 9 million trees, 6.9 million of which are expected to contribute to carbon removal over their lifetime, according to Nespresso’s Road to Net Zero.

PepsiCo and Walmart have also implemented ambitious insetting initiatives involving regenerative agriculture, and recently announced their joint commitment to supporting regenerative agriculture across more than 2 million acres of farmland, which is predicted to lower GHG emissions by approximately four million metric tons by 2030.

In the cosmetics industry, L’Oréal has facilitated the transition to improved cook stoves in West Africa that require less wood consumption when boiling shea nuts, a major ingredient in many L’Oréal products. Not only has this project in Burkina Faso prevented deforestation and cut GHG emissions, but it also has improved local livelihoods by reducing unpaid domestic work by the female workers, primarily spent preparing meals and collecting wood.

Implications

A more holistic approach to addressing residual emissions

The rise of carbon insets—which offer multifaceted benefits to communities and ecosystems across a company’s supply chain—reflects a shift to a more holistic approach to emission reductions. As companies shift away from purely GHG emission reductions and embrace a more comprehensive sustainability strategy to reach their net zero goals, it is expected that a rise in demand for projects with non-climate local benefits to follow. While companies should prioritize decarbonizing their internal operations, industry leaders are beginning to consider how insetting plays a role in their strategy, particularly in addressing their residual emissions.

Demand shifts from generic offsets to tailored insetting projects

Carbon insets also show that many organizations are searching for more agency on their road to net zero. By choosing to invest in projects within their own supply chain (rather than outsourcing emission reductions to third parties), companies can monitor and oversee their emission reduction efforts more diligently. This is in part driven by the recent controversies in the carbon market surrounding low-quality credits, which has made many companies weary of unknowingly investing in low-quality carbon projects. For carbon project developers, this might indicate a broader shift toward tailored projects and a reduced appetite for existing carbon credits. However, this also represents a growing opportunity for developers to collaborate with companies to develop high-quality insetting projects within their value chain.

Need for adequate regulations and monitoring

As of now, however, many of the concerns around offsets—namely, non-additionality and double-counting—might also apply to insets. This is largely because of the difficulties in accurate regulation around carbon offsetting and insetting projects alike. While the monitoring and verification of carbon offsets already prove to be challenging, this is even harder to enforce for insetting projects, which are conducted by companies themselves and are not required to be validated by an external registry or organization. This poses a risk to the development of low-quality projects that fail to achieve the original net zero targets set out by companies.

Despite the challenges and struggles with proper verification and accounting of carbon insets and offsets, it is crucial to recognize that all efforts towards achieving a net-zero economy are essential. In order to limit global warming to 1.5°C, as outlined in the Paris Agreement, we need to do everything we can, including aggressive decarbonization and utilizing carbon insets and carbon offsets alike, to collectively save our planet.

-

Are you an organization looking to develop your insetting strategy, or a carbon project developer looking to partner with organizations and create insetting projects? Please get in touch – we would love to speak!

Since you made it this far, why not sign up for our newsletter?

Since you made it this far, why not sign up for our newsletter?

See what's possible

Build your sustainable brand presence while investing in the planet together.

See what's possible

Build your sustainable brand presence while investing in the planet together.

See what's possible

Build your sustainable brand presence while investing in the planet together.

See what's possible

Build your sustainable brand presence while investing in the planet together.

Stay up to date

2024 NetaCarbon. All rights reserved.

Stay up to date

2024 NetaCarbon. All rights reserved.

Stay up to date

2024 NetaCarbon. All rights reserved.

Stay up to date

2024 NetaCarbon. All rights reserved.